Weekly Option Trades (June 23-27, 2025)

No option trades this week. Below my market commentary, macro-economic update, and my option trading strategy update.

If you enjoy reading my free newsletter, please click the ❤️ button and restack it so more people can discover it on Substack. Thank You 🙏

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and should not be construed as financial advice or as a recommendation for any specific security or trading strategy. My assumptions and observations were only valid at the time of trade execution and, for this reason, the trades described in the newsletter should not be mirrored. I share my trades and the rationale behind them exclusively for the purpose of teaching technical analysis and option trading techniques.

To receive Live Trade Alerts, Detailed Trade Reports on the day of trade execution, weekly snapshots of my Options Portfolio as well as access to the HB7 Trading community chat, join my subscription on Patreon.

Market Commentary

Nothing could stop markets this week. Not the US strike on Iran, not the increasing continued unemployment data, and not even slightly hotter inflation than expected.

On Friday, after an initial pop, sellers stepped in and pushed markets lower intra-day, before staging a late come back. The S&P 500 managed to close at a new all-time high, closing at 6,173 above the previous top from Feb 19, 2025 of 6,147. It's been a remarkable recovery from the lows on Apr 7, 2025. Initially, it looked like we would get a 'shooting star or inverse hammer' candle formation on Friday, often a sign of a reversal and pullback, but with the late surge buyers and sellers were ultimately pretty balanced. We'll see what happens next.

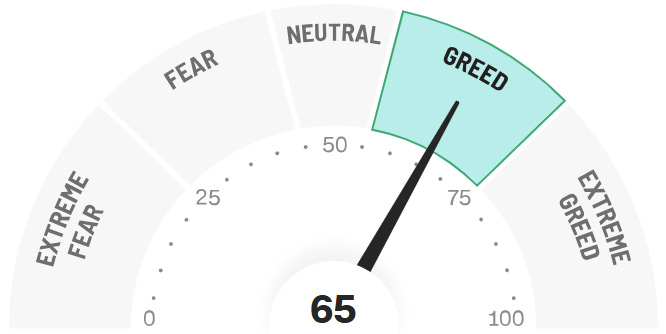

Market sentiment has reached 'Greed' levels this week, as shown by the Fear & Greed index below. Also, the RSI of the S&P 500 has reached a reading of 70, entering overbought conditions (see S&P 500 charts below). A pullback from these levels or at least a consolidation is likely in the near-term, and would be healthy for a potential new leg higher.

Macro-economic update:

Data released this week:

New Home Sales plummeted -13.7% and inventory rose +1.4%.

Existing Home Sales ticked up just 0.8% with inventory increasing +6.2%.

The above data show that high home prices and high mortgage rates continue to hold buyers back. Something to monitor closely.

Consumer Confidence fell 5.4 points in June (both the perception of the present and future expectations fell).

Consumer Sentiment, on the other hand, rose 8.5 points.

The PCE Price Index came in at 2.3% Y-o-Y, in line with expectations. The Core PCE Price Index, the Fed's preferred gauge, came in higher than expected at 2.7% Y-o-Y.

Continuing unemployment claims jumped this week, something to keep a close eye on. It is getting harder to find jobs.

Next week:

ISM Manufacturing and Services Reports (both are currently in contraction territory)

Employment Report

A reminder that US markets will be closed on Friday, July 4th, due to the Independence Day Holiday.

Strategy Update:

This week, I did not do any trades (it doesn't happen often). With markets pretty much just going straight up every day, I did not find attractive risk/reward set ups for new cash-secured puts.

Many of the markets' darlings trade at very high RSI readings in extreme overbought territory. This is not ideal to sell new cash-secured puts. Put premiums are low unless for strikes close to the money and a pullback is likely.

It's a great time to sell covered calls. I had recently rolled all my calls out and there wasn't much to do for me, except to closely monitor the SOXL calls (see my separate note).

I am watching a few stocks for potential new cash-secured put trades. Stocks that haven't participated as much in the recent rally and that trade at more neutral RSI readings. Examples are AAPL, QCOM, and a few others, also some non-tech stocks. TSLA has cooled down as well, but is expected to report vehicle delivery numbers next week (a bit like earnings) and could disappoint again.

Also, I am considering adding additional strategies.

So far, I have been very much focused on avoiding assignments. This makes me quite a conservative trader, and keeping me on the sidelines in times when stocks mostly go up, like the previous few weeks. This week made me think that I'd like to have more stocks to sell covered calls on. I am considering adding more trades with a 'Wheel' mindset, rather than focusing on strictly avoiding assignment. I would sell puts somewhat closer to the money or not be as concerned about pullbacks, and assignment would be just fine or even desired to then sell covered calls. There are often times when selling covered calls is more profitable. I'd mention it in my trade alerts if a trade is a 'Wheel' trade or if I try to avoid assignment.

I also consider adding spreads, for example, bear credit (call) spreads for extremely overbought and overextended stocks, like we see currently, or bull credit (put) spreads. Spreads have limited risk/loss if markets don't do what you expect.

Let me know any questions or comments.

Best regards,

Tim | HB7 Trading

To receive Live Trade Alerts, Detailed Trade Reports on the day of trade execution, weekly snapshots of my Options Portfolio as well as access to my HB7 Trading community chat, join my subscription on Patreon:

Please support my Substack and share it with friends, colleagues, and family:

If you enjoy reading my newsletter, please click the ❤️ button and restack it so more people can discover it on Substack. Thank You 🙏